Asset Allocation

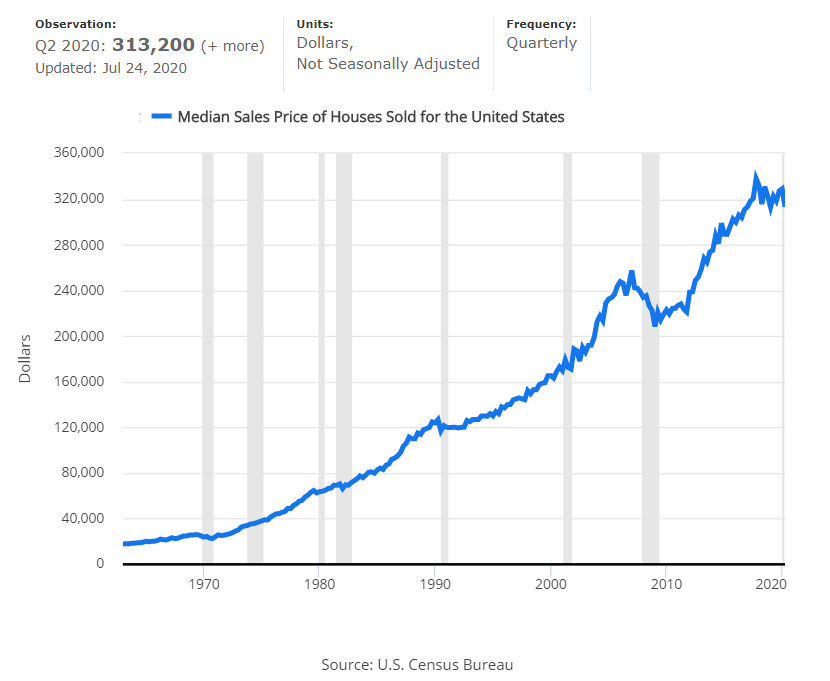

When it comes to saving and investing, I’ve learned over the course of my 35-year career as a financial advisor, entrepreneur, and professional investor, that diversification matters significantly. Which assets should prudent players focus their time, energy, and resources on? The National Bureau of Economic Research Rate of Return on Everything has been tabulating returns of leading asset classes from 16 advanced economies since 1870. Their analysis reveals that there are two investment classes that stand out, residential real estate and stocks.

Major findings→

“In terms of total returns, residential real estate and equities have shown very similar and high real total gains, on average about 7% per year. Housing outperformed equity before WW2. Since WW2, equities have outperformed housing on average, but only at the cost of much higher volatility and higher synchronicity with the business cycle. The observation that housing returns are similar to equity returns, yet considerably less volatile, is puzzling.

Before WW2, the real returns on housing and equities (and safe assets) followed remarkably similar trajectories. After WW2 this was no longer the case, and across countries equities then experienced more frequent and correlated booms and busts.

The low covariance of equity and housing returns over the long run reveals potential attractive gains from diversification across these two asset classes that economists, up to now, have been unable to measure or analyze.“

The Rate of Return on Everything, 1870–2015, NBER

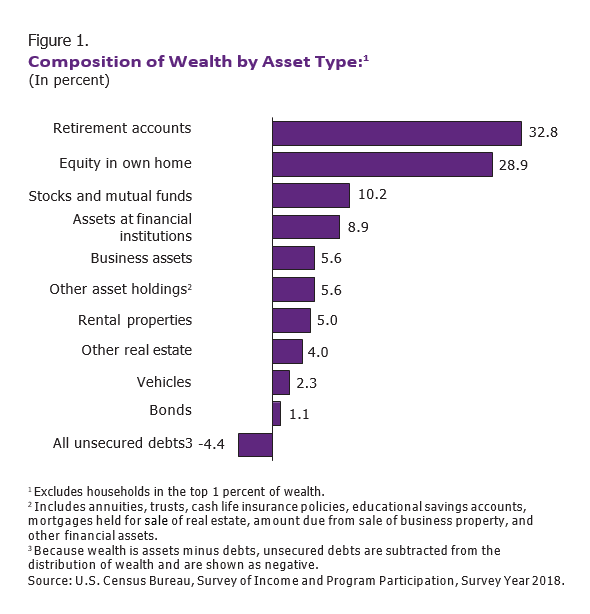

My job as a professional money manager* is to select investments that are seemingly appropriate for the current economic horizon, and poised to provide returns commensurate to the relative risks inherent in various asset classes. The bulk of wealth held by American households is in home equity and retirement accounts, comprising over 60%. The remaining 40% comprises stocks and funds, bank accounts, business interests, other assets, rental properties, second homes, automobiles, and savings bonds, as depicted below. With the influx of trillions of dollars from fiscal spending, monetary intervention, and zero interest rates, how should savers and investors invest to attain and sustain financial well-being?

Are Stocks Overvalued?

84% of Fortune 500 CFOs say the US stock market is overvalued, according to a survey released Thursday by Deloitte. Only 2% of chief financial officers say US stocks are undervalued.

Interest parties that would like to delve further into this question can message me.

What about Residential Housing?

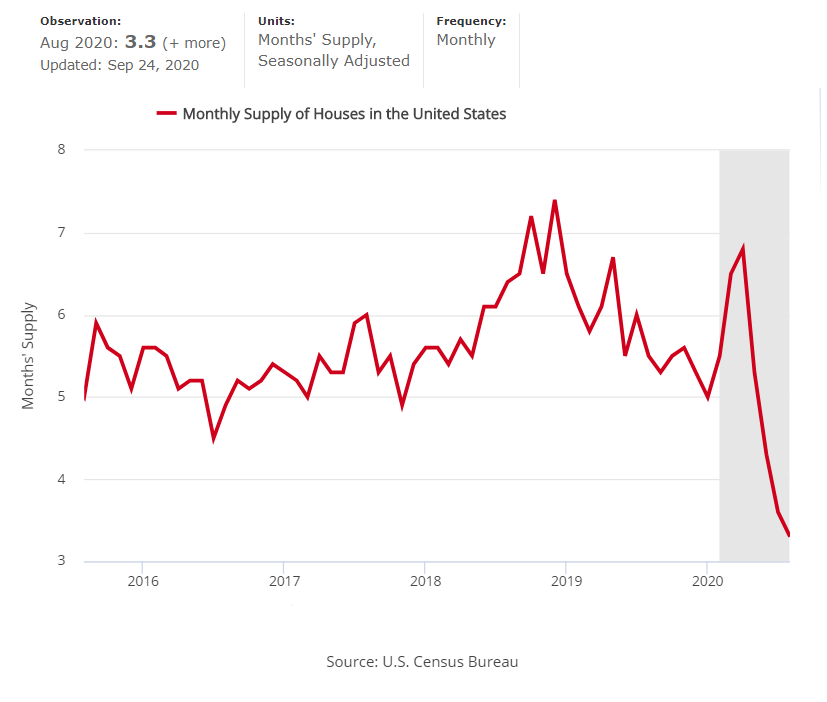

As a professional money manager, I am agnostic to media hype and whims. Warren Buffett says, “Markets are voting machines short-term, and weighing machines long-term.” By that, Mr. Buffett means that fundamentals will ultimately determine price over time. What’s my opinion about housing as one’s permanent residence or as an investment? From the chart above, it is apparent that the demand for homeownership has strengthened during the recession. Total housing inventory has plummeted to 3.3 months worth of housing stock. For those interested and liquid, diversifying into single-family properties has historically been a staple in investors’ portfolios.

*The author of this article, William Corley, is the founder of 1st Discount Brokerage, Registered Representative, Investment Advisor Representative. William is a REALTOR® at BitRealty. 1st Discount Brokerage and BitRealty are not affiliated; they are two separate entities.

Disclosures: Any views, thoughts, and opinions pertaining to the subject matter presented in this post are solely the author’s subjective opinions, and do not reflect the official policy or position of 1st Discount Brokerage, Inc. Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Any examples, outcomes, or assumptions expressed within this article are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Dollar-cost averaging, diversification, and rebalancing strategies do not assure a profit or protect against losses in declining markets. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses in declining markets. Assumptions made within the analysis are not reflective of 1st Discount Brokerage, Inc. nor its personnel. 1st Discount Brokerage, Inc. is a licensed FINRA Broker-Dealer and Registered Investment Advisor. Securities offered through 1st Discount Brokerage, Inc., Member FINRA/SIPC.