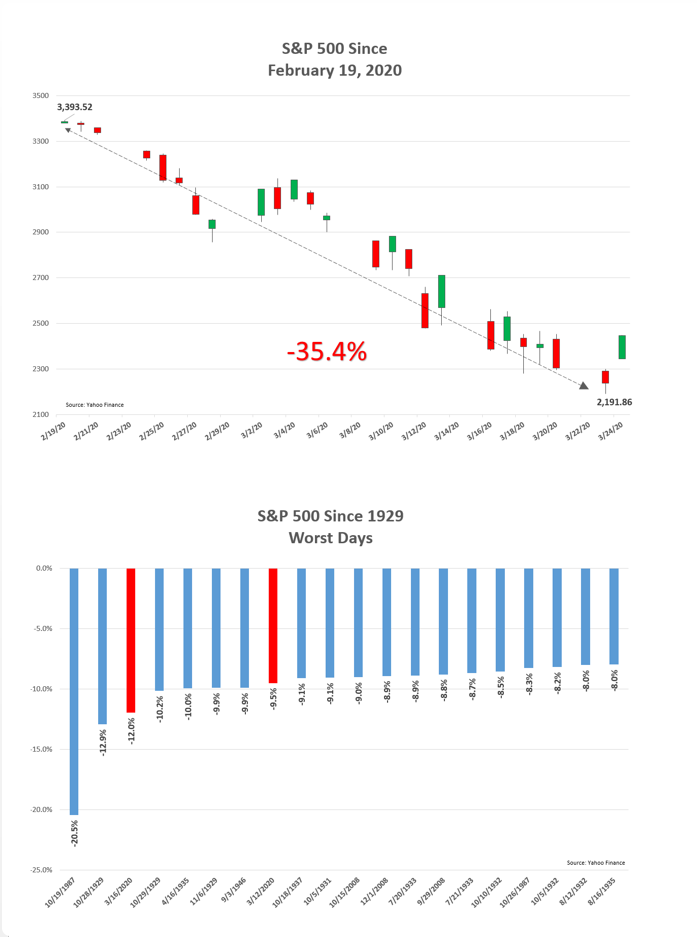

The S&P 500 just endured two of the ten worst days since the Great Depression. The index of 500 leading companies plummeted -9.5%, and -12%, on 3/12 and 3/16, respectively. The experience has been undesirable. Market lore foretells that “Bear Market Bottoms” are unlikely to be singular moments, instead, painfully, more apt to be a process of events accompanied by unwanted volatility. The silver lining being higher lows. Generally, some catalysts assist in establishing bear market reversals, such as stimulative monetary and/or fiscal policy. It is then, the excess supply of sellers may dry up from exhaustion and capitulation. Basic economics, stocks either go up or down because of supply and demand. Once the supply/sellers mark down their merchandise to fire-sale prices, i.e. (liquidate their unwanted equity holdings), demand picks up as bargain hunters step in and buy on the cheap. Will steely nerved buyers be rewarded for their guts? Since 1929, there have been 17 bear markets, the longest and shortest time frames for the bottom to occur was 3.5 years in ’42, and 87 days in ’90. As of this post, we have witnessed the market falling -35.4% from its 2020 intraday high and low; the bear market is now on day 35. 1db.com/disclosures/