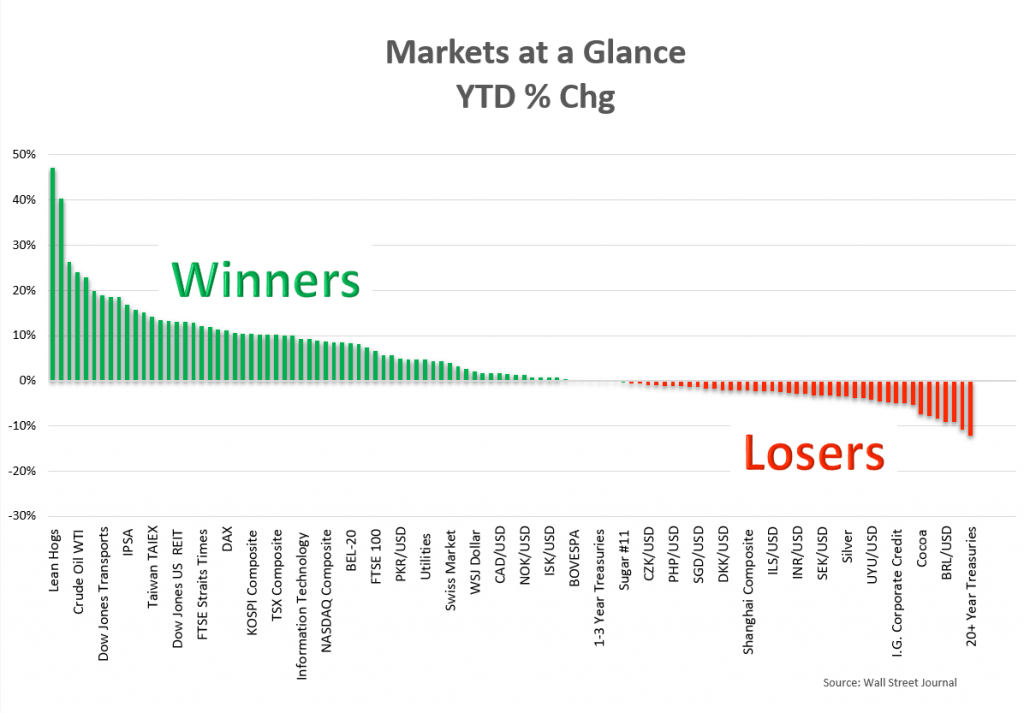

Winners→

We live in a new world, an era, where the abnormal is the new normal, and where the unknown is the known. In 2021, as in all periods, there are winners and losers. Hogs, i.e., the cost of pork (not in political parlance) has increased 50%. Other year-to-date standout sectors → energy, industrials, financials, and value-centric investments have prospered. In the United States, the consumer is the 800-pound gorilla. Consumer expenditures account for 70% of total U.S. economic activity. The consumer sector has been robust and has bolstered demand for goods and services, but also financial assets, thusly, raising equity values. Not to be left behind, the housing market has been noticeably active.

Residential home prices have risen by double-digits over the past year and values have been buttressed by favorable interest rates and record low inventory Home equity accounts for approximately 30% of household wealth. Seemingly, asset classes that are perceived to be growth-oriented or storeholds of wealth, have forgotten about the coronavirus pandemic bear market low point back on March 23, 2020, which put tens of millions of Americans out of work and plummeted our nation into its 12th recession since World War II. Indeed, it has been a tale of two cities; there are the millions of individuals and families that remain out of work and who have suffered immeasurably, while others, particularly the well-to-do, are by far richer than ever before.

Losers→

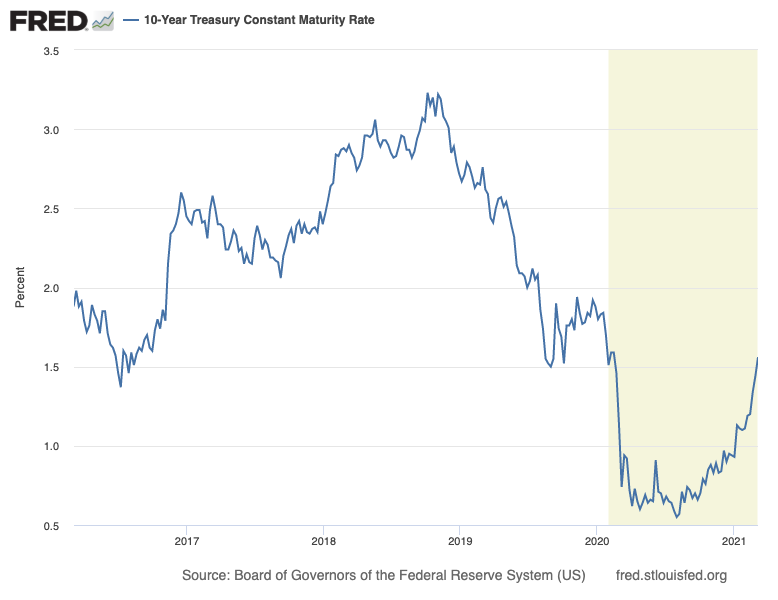

Long-term bonds, particularly treasuries and investment-grade credits have been under pressure since the 10-year treasury low back in mid-summer 2020. Since year’s end, 10 and 20-year treasury yields are .6% and .8% higher, and investors are in the red 5.75%, and 13.98%, respectively, according to ishares.

10-Year Note Yield Triples

The 10-year treasury note is considered a proxy for the rate of inflation. In August, the 10-year yielded .52%, now it is paying nearly 1.7%. The interest rate remains low on a historical basis but has turned up sharply. The federal reserve has telegraphed that it prefers inflation to run for the intermediate period in excess of its 2% long-term target inflation rate. Now, the outstanding question is will the bond market act accordingly, or not?

Buy → Bolt or → Buckle-up

Americans with stockholdings and homeownership have benefitted significantly from Washington’s $12.4 trillion, “do whatever it takes” public policy response to offset the contractionary effects caused by the pandemic, coupled with global central banks’ negative real interest rate stance and money printing agenda. And, more stimulus continues to pour into the U.S. economy by way of President Biden’s $1.9 trillion American Rescue Plan Act of 2021. Those proceeds added to $10.5 trillion previously authorized to be allotted is equivalent to 60% of our nation’s $21 trillion in total economic output of goods and services.

What’s next?

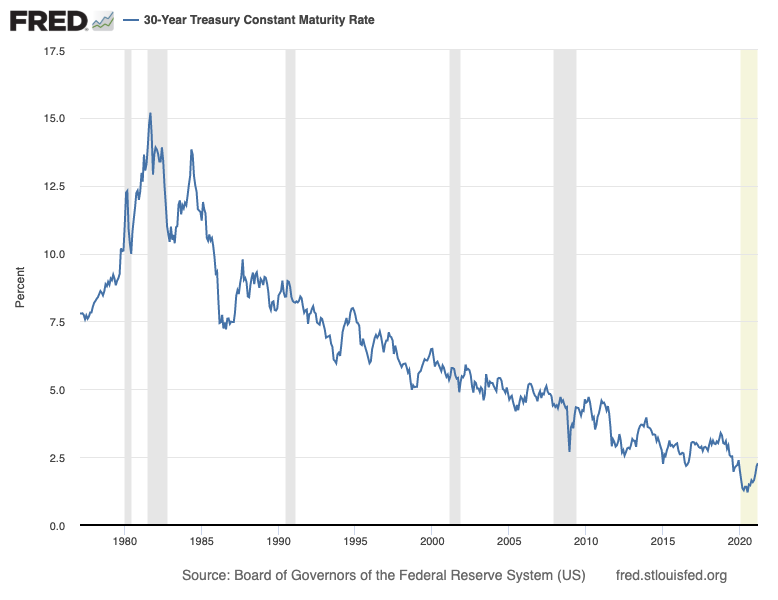

The bond market is reputed to be where the risk-averse patient money is stashed, even though the negative real return (current bond rate minus inflation) assures holders under these conditions of a loss of inflation-adjusted purchasing power. Bond yields have been on the downward slope over the past 40 years, until now?

Caveat Emptor – Investors Beware

2021 has started off in the right direction, and still, keeping the U.S. economic locomotive forward to benefit all Americans requires vigilance. I’ve listed five global risks that prudent investors may be aware of.

- Vaccine rollout delays and interruptions

- Corporate profit projections peter out

- Employment growth deceleration

- Superpower trade disputes

- Monetary mishaps

The future of investing is now → 1db.com