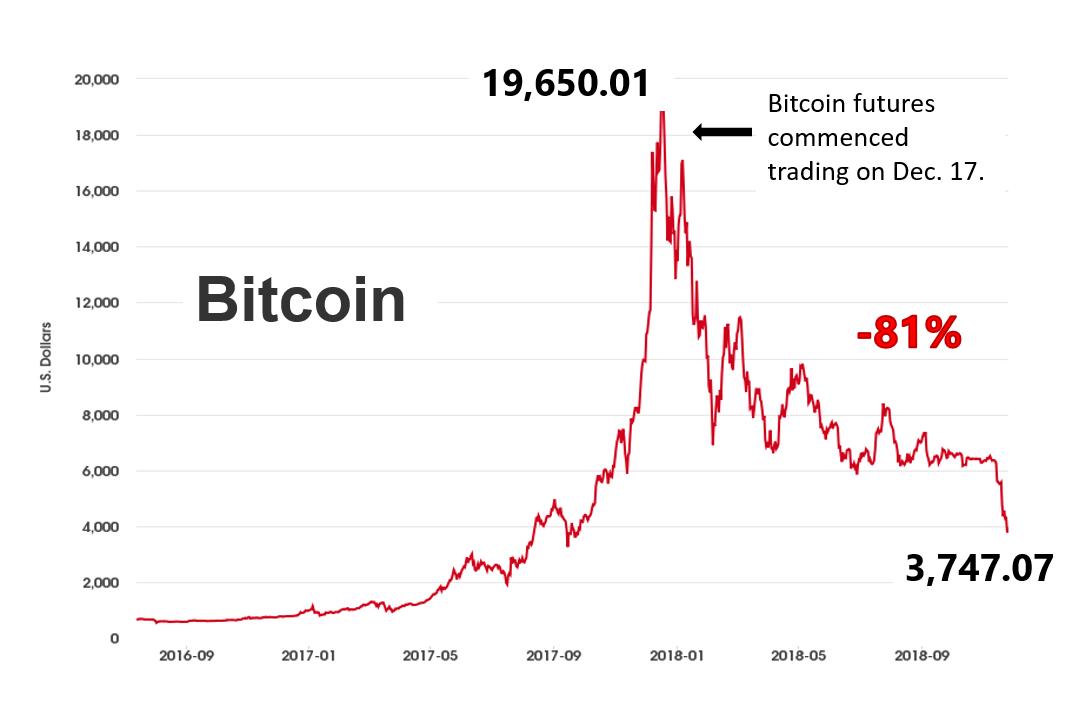

Twelve months ago, a conservative investor could have invested their money into 1-year treasury yielding 1.19%; treasuries are considered the safest securities and guaranteed by the Federal Government. Conversely, for those less cautious, say the more venturesome and daring types who chose to purchase Bitcoin(s) over this timeframe, they too are nearing a return of just over 1%. Incidentally, the top in the advancement of Bitcoin’s meteoric ascent coincided with the futures markets trading Bitcoin. So what happened? The futures market enabled professionals to bet on the downside, that is, that Bitcoin would crater. Who are the winners and losers?