Today’s economic story is a tale of two cities:

▲There are fortunate folks who have remained gainfully employed and been able to manage okay during this COVID-19 meltdown. Many of these workers are stock market participants and, after the worst kind of market volatility and violent selloff, have seen their investment portfolios resurrected by the government’s multitrillion monetization experiment, which appears to have ushered in a new bull market posthaste. Long term investors, who have disposable income and invest on a regular basis incrementally, have been able to buy equities on sale; for them, it has been a veritable silver lining.

▼Simultaneously, in a dark parallel, there are 30 million others who are now unemployed after witnessing the bottom fall out of their working livelihoods mostly in travel, leisure, hospitality, entertainment, dining, drinking, and events. Each of these individuals has been doing their part, equally important, in contributing to the human condition by providing labor in industries that somehow seem to be spurned and forsaken. What’s worse, these hardworking contributors no longer know if they will even have a job when the economy reopens. Is this a depression? Many families are suffering from both physical and economic mortal wounds. They have been forced to live off the temporary quasi-universal basic income that comes to an end in a matter of weeks.

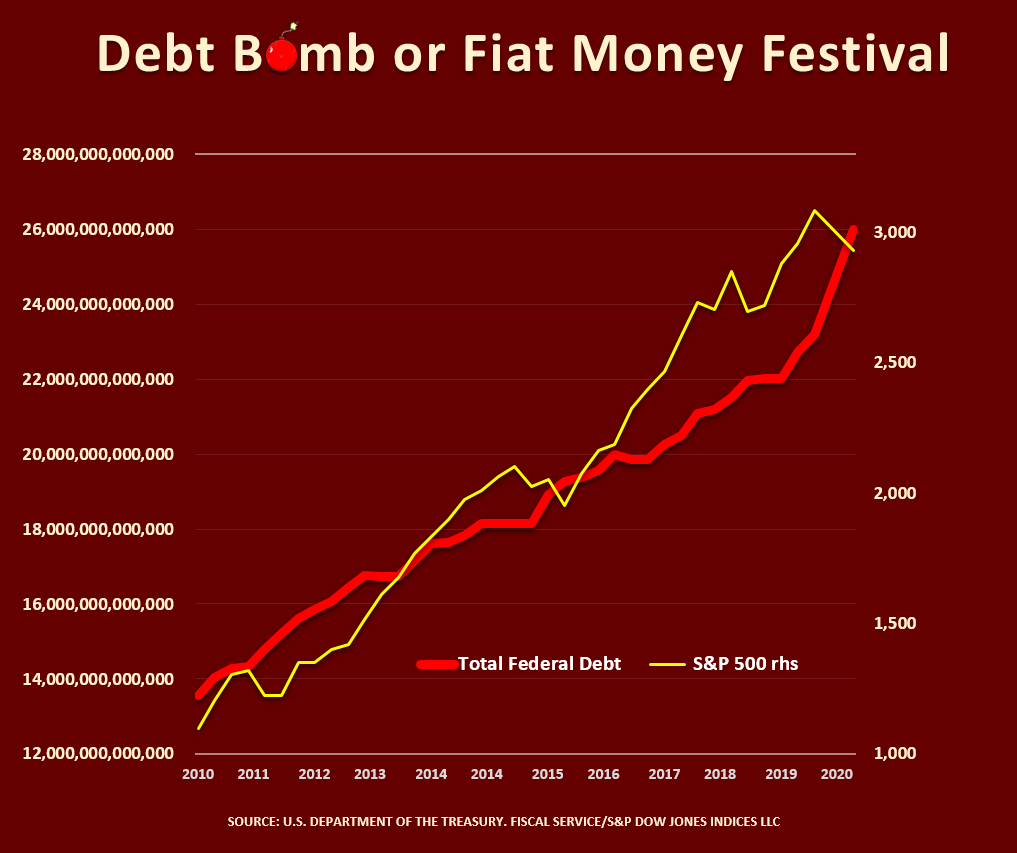

►The great virus contagion has been summarily addressed by governments as they try cooperatively to stem the spread and restart the world’s economic engine. The #USTFED has squashed interest rates to zero. Global central banks, led by the #FED, are attempting to counter the economic sudden stop by providing an open-ended checkbook of helicopter money to fund and fuel Main Street, accompanied by a billion-dollar buying binge of marketable securities to definitively pad Wall Street.

Accordingly, the increase in public debt is disconcerting. Only time will tell if the concoction that is being served to everyone is friend or foe. Rule #4