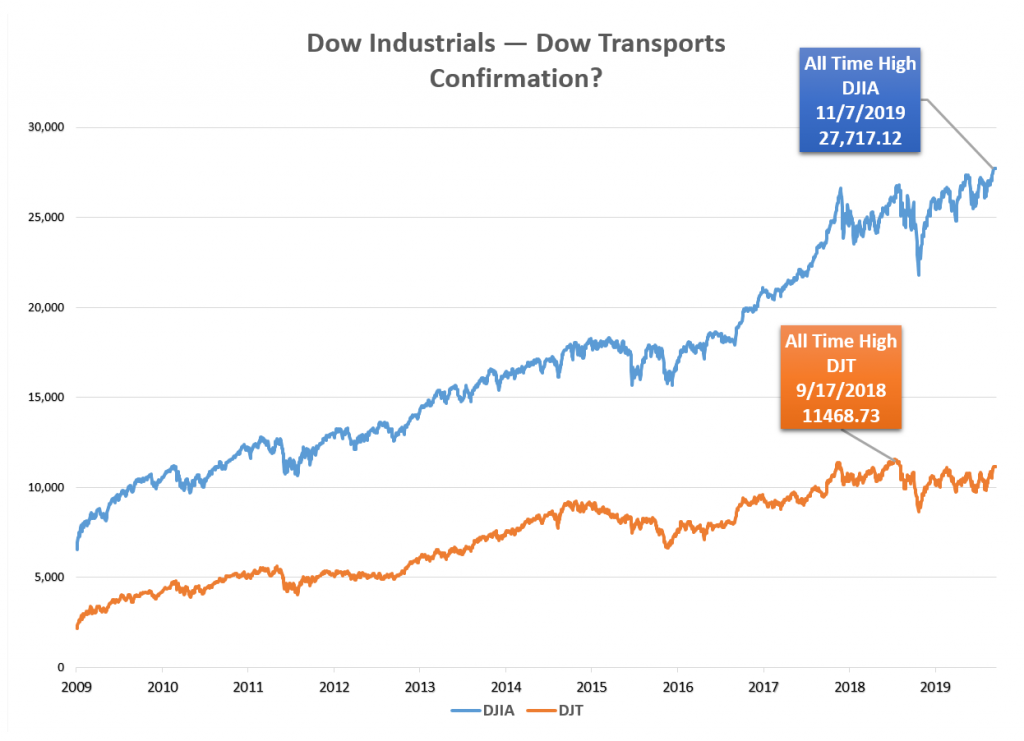

Dow Theory is a century-old stock-market supposition that has been used to forecast the stock market’s directional trend. Dow Theory assumes for an upwardly bias/economic tendency to continue, and be confirmed, both the Dow Jones Industrial Average (DJI) and Dow Jones Transportation Average (DJT) should be moving in the same direction.

Assumably, if the DJI rises, so should the DJT, and vice versa. Preferably, when the industrials set an all-time-high, transports should follow suit. Theorists believe that as long as both indices rise and fall together, the economic trend will respond accordingly. Today, the Dow Jones Industrials is at record levels, while the Dow Transports set there record high back in September 2018. Interestingly, as of this post, Transports have risen 7.3% in Q4, versus 3.2% for the Industrials. 1db.com/disclosures/ hashtag#digitaladvisor