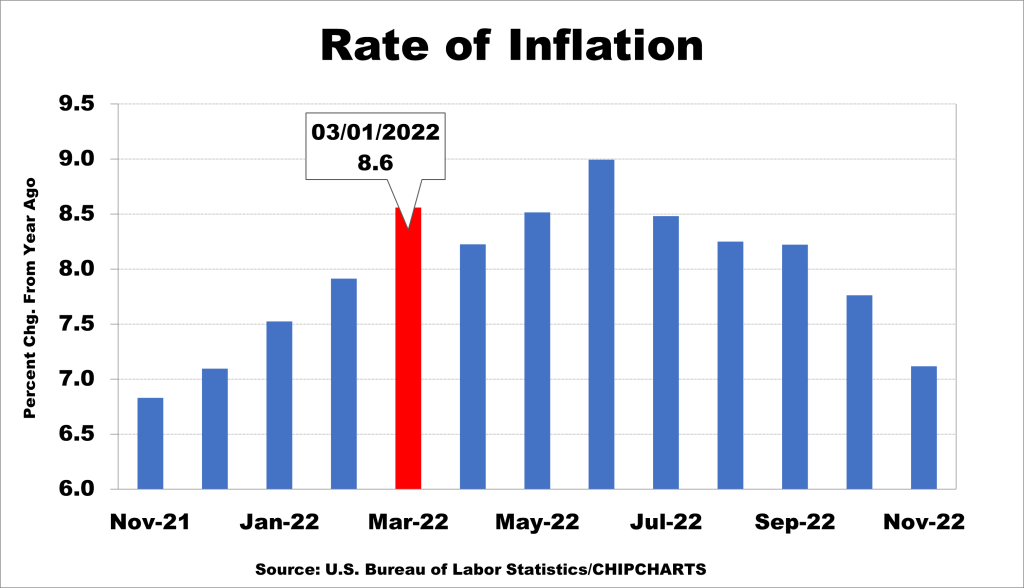

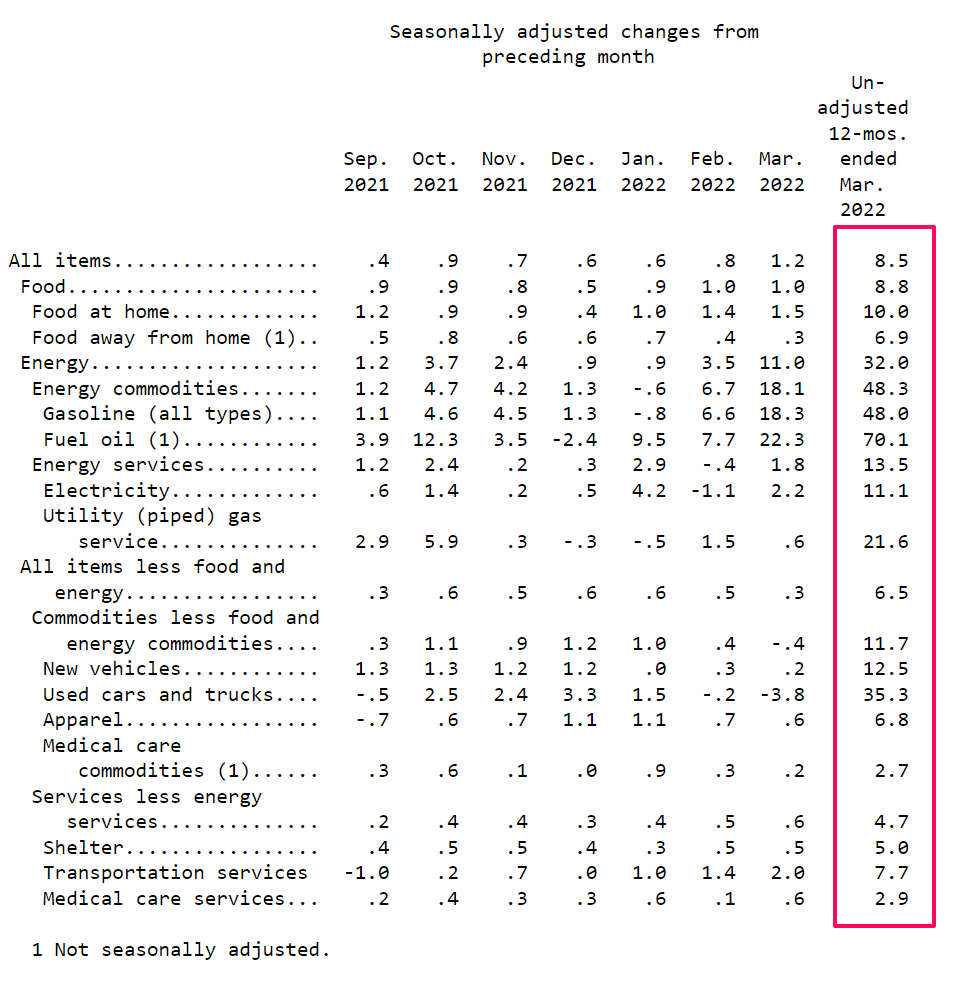

Why did the Fed wait until March 16, 2022, to raise the Fed funds rate from zero to 0.25 percent, with inflation running at 8.55%?

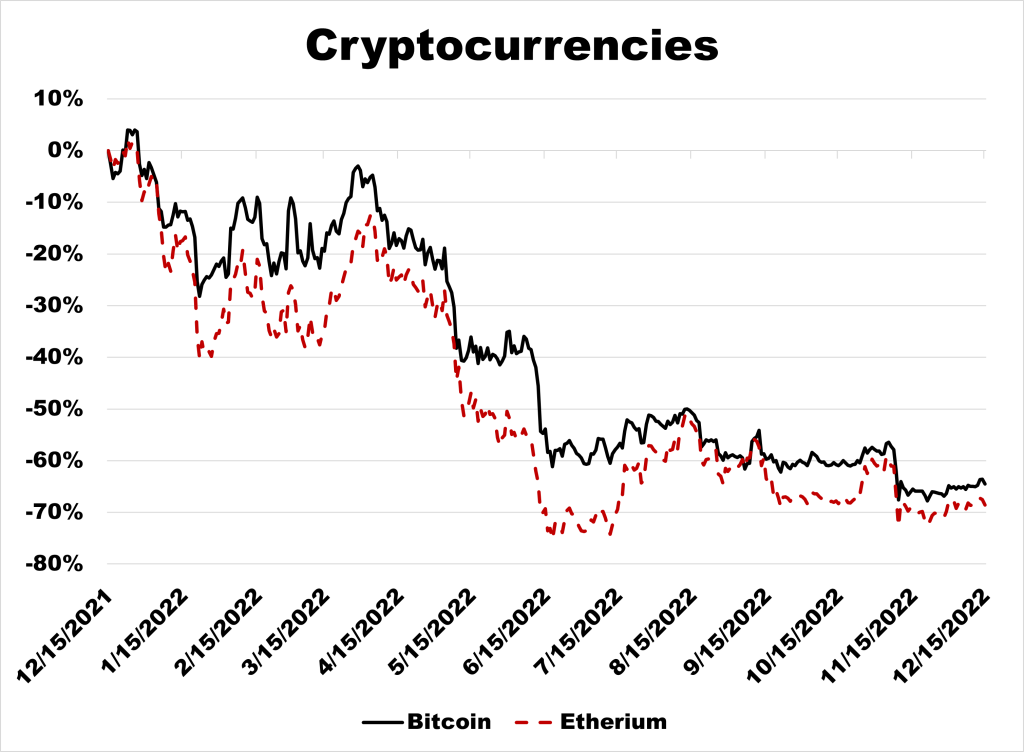

Why did the Federal Reserve’s expansive monetary policy, known as ZIRP (zero interest rate policy), create bubbles in crypto, SPACS, meme stocks, and unprofitable technology companies and then burst it?

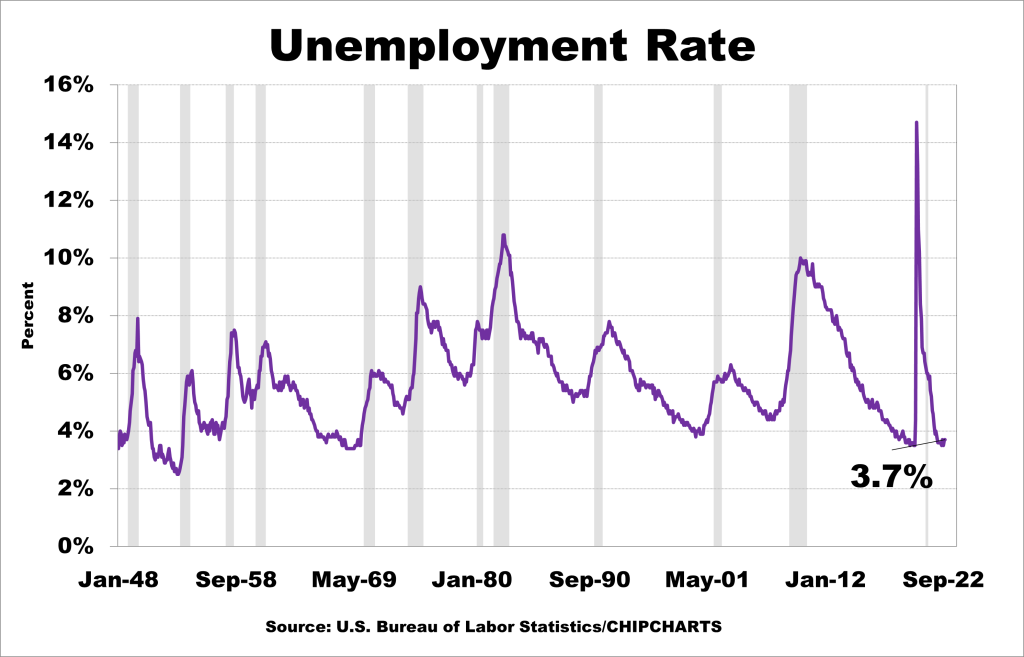

Why did the Fed continue its quantitative easing to stimulate economic activity (by reinvesting principal payments into treasuries and mortgage-backed securities) that notably financed continued excess spending, concurrently with unemployment filings at the lowest in over half-century?

Why did the Fed remain entrenched in its dovish stance with prices soaring and the unemployment rate plummeting?

Why is it that the Fed articulates that “rate changes have long and variable lags,” yet they are now in a rush to raise rates faster than ever?

Why does the Fed insist on slamming on the breaks to protect everyone, especially those most vulnerable to rising prices, when working folks are at considerable risk of losing their jobs during recessions?

Since the Federal Reserve defines “maximum employment” by the nonaccelerating inflation rate of unemployment (NAIRU) and declared that it was achieved in January, why did they decide to flood their system with an unnecessary excess of easy money?

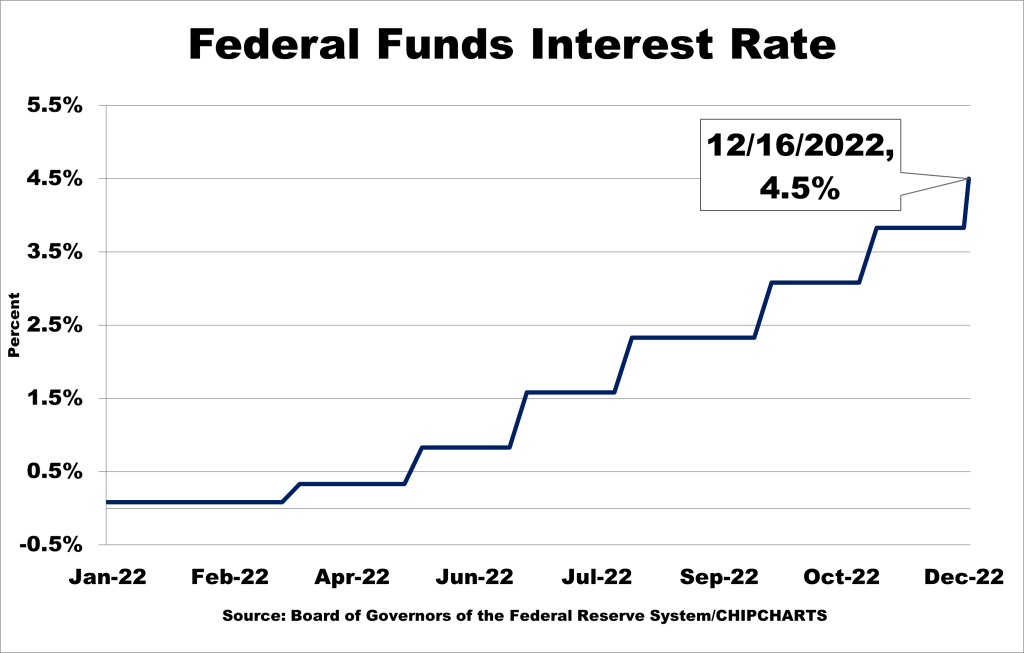

The answer lies in the fact that the Fed’s zero-interest-rate policy (ZIRP) was intended to stimulate (not overheat) economic growth by increasing lending and investment. The primary intention of this policy was to encourage banks to lend money and businesses to invest in new plants and equipment—in turn, creating jobs. The policy worked. However, those in charge kept zero interest rates full-on past the boiling point sending the cost of everything skyward, while the unemployment rate was sitting near its lowest level in 50 years.

We are witnessing ZIRP’s unprecedented downside: it led investors to take on more risk to gain higher returns. This created a bubble of excessive speculation and leverage, which eventually had to burst. As the economy slows, companies will be forced to cut back on investments and lay off employees while speculators lick their wounds and investors endure losses into the foreseeable future. The Fed’s policy of keeping interest rates at zero for so long also led to a rise in inflation that has virtually squeezed out working families from being able to purchase a home. This is a dire state in American history.

The Fed finally moved to raise interest rates on March 16, but it was too late to prevent the bubble from bursting. By that point, the excesses of ZIRP had already caused significant undue stress to the U.S. economy. The Federal Reserve Chairman and Treasury Secretary held clenched fists to their stance that inflation was transitory.

The lesson here is that the Federal Reserve needs to be far more careful in its use of its Fed speak and monetary policy tools and recognize when their effects can lead to unwanted, unintended consequences.

Ultimately, the Fed’s ZIRP bubble flub-up is an important reminder of the need for responsible central bank policy—especially when setting monetary policy. By better understanding the risks associated with its actions, the Federal Reserve can avoid repeating such mistakes in the future.

Thank you for reading! Please leave any comments or questions below.

William Corley