Cash has been yielding zilch for most of the previous decade. Not now!

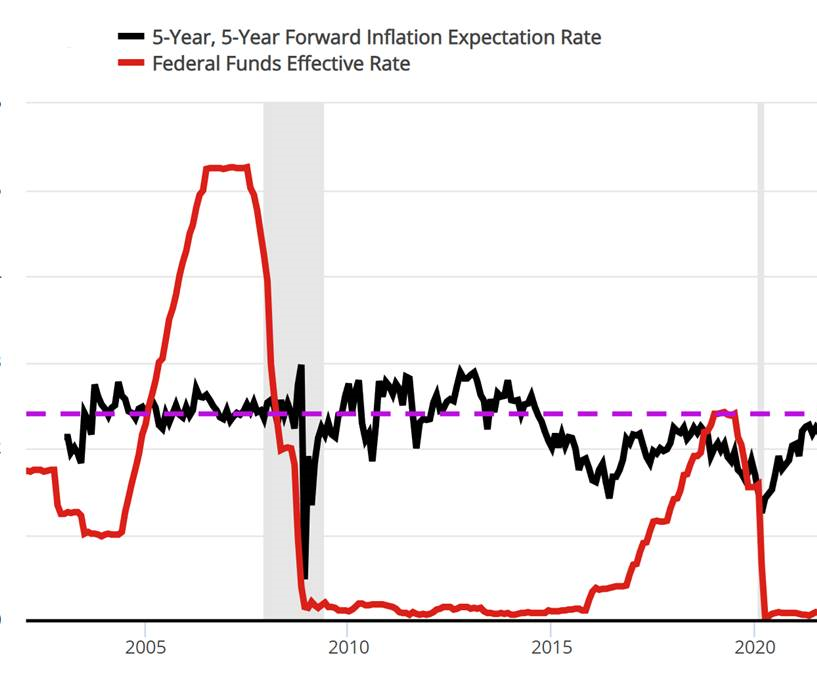

The red line depicts short-term interest rates, while the black line projects the inflation rate. The purple dashed line signifies where savers are earning more interest than inflation, or what we know as real rates (sources: U.S. Treasury, St. Louis Fed).

After the Great Financial Crisis, savers and retirees have struggled to find effective places to invest their money. With interest rates at near zero, many were forced into riskier investments like stocks and bond funds. But that is changing now as rates begin to rise again.

Some of us, including me, prefer to have an ample prudent reserve in cash and equivalents for safety. Unfortunately, cash has been yielding zilch for most of the previous decade. Not now!

Disclosure Any views, thoughts, and opinions expressed within this communication contains subjective opinions, and do not reflect the official policy or position of 1st Discount Brokerage, Inc.

Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.

Investments involve risk and are not guaranteed. Past performance is no guarantee of future results.

1st Discount Brokerage, Inc. is a licensed FINRA Broker-Dealer and Registered Investment Advisor.

Securities offered through 1st Discount Brokerage, Inc., Member FINRA/SIPC.