SHORT VERSION → Inflation Reversion

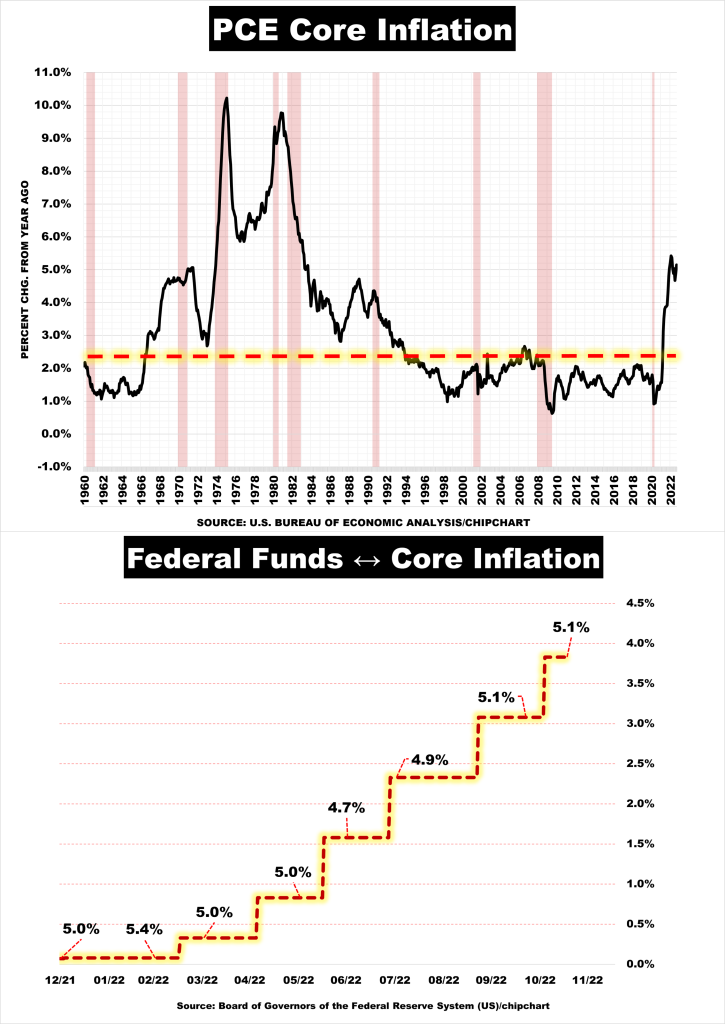

Core Inflation has averaged 3.2% over the past 62 years. Core Inflation is currently 5.1%; the FED’s target rate for inflation is 2%. How long will it take for Core Inflation to revert from 5.1% to 2%? Take notice during the 70s and 80s when inflation spiked above the 2% target, the time it took to revert back towards its historical mean (sources: Federal Reserve, BEA).

There are considerable factors that impact when inflation reverts to normal: central bank economic policies, political stability, technological advances, energy prices, and confidence in the national currency.

- Central bank policies can be used to control inflation by adjusting interest rates and changing the amount of money available in circulation.

- Political stability helps because it encourages businesses to invest and hire more people, increasing economic output.

- Technological advances create more efficient production processes, lowering costs and prices.

- Energy prices can also impact inflation since they determine the cost of transportation, manufacturing, and other services.

- Confidence in a nation’s currency and economy can help stabilize prices by making the value of that currency more attractive to international investors.

With these factors in mind, economists and analysts guesstimate when inflation might revert to normal levels.

LONG VERSION → Inflationary Headwinds for Americans

1. Higher prices for goods and services: Inflation causes the cost of living to increase, leading to higher prices for everyday items like food, clothing, transportation, medical care, and other necessities.

2. Decreased purchasing power: As prices go up due to inflation, people’s money buys less than it used to; individuals and families may not be able to afford basic necessities as they did when their dollars went further.

3. Increase in business costs: Inflation also leads to increased production and operating costs, which then are passed on to consumers in the form of higher prices.

4. Decreased savings: When prices start to outpace wage growth, it’s harder for people to put money aside and save for emergencies or their future, especially when real rates are negative.

5. Lack of investment by businesses: With higher costs and lower confidence in their future prospects, businesses may be less inclined to invest in new projects or hire more employees.

6. Wage stagnation: When inflation is high, wages may not keep up with the pace of price increases, leading to an overall decline in purchasing power and quality of life.

7. Decreased government services: As governments struggle to manage rising costs associated with inflation, they may cut back on services to citizens in order to save money.

8. Devalued currency: As inflation increases, the value of a nation’s currency can decrease. This can make it harder for citizens to purchase imports and makes travel abroad more expensive.

9. Loss of international competitiveness: When prices rise faster than wages, businesses will find it harder to compete internationally with countries that have lower inflation rates.

10. Increased debt: As prices rise faster than income, individuals and families may take on more debt to cover everyday living costs, leading to an unsustainable cycle of borrowing and repayment.

Published by

Author of Financial Fitness: The Journey from Wall Street to Badwater 135; Public Speaker; Professional Money Manager with 1DB.com.

Disclosure: any views, thoughts, and opinions expressed within this communication contains subjective opinions, and do not reflect the official policy or position of 1st Discount Brokerage, Inc.

Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.

Any examples, outcomes, or assumptions expressed within this communication are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based only on very limited and dated open-source information.

Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Securities offered through 1st Discount Brokerage, Inc., Member FINRA/SIPC. A Registered Investment Adviser.