There’s been plenty of clamoring that economic downturn would begin in 2019. NYT’s columnist and Nobel Prize-winning economist Paul Krugman has emphatically warned investors that a Trump victory would “trigger a global recession with no end in sight.” In February, he forecasted a recession for latter 2019. Next, there was the imminent threat stemming from the “inverted yield curve,” when short-term interest rates rise to yield more than long-term rates. Mainstream media pounced on the dire data and pessimistic predictions.

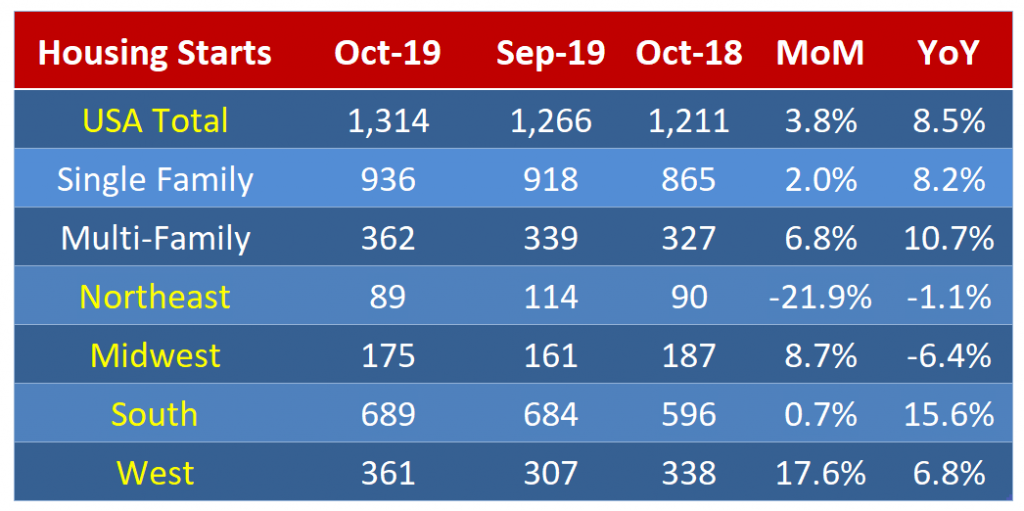

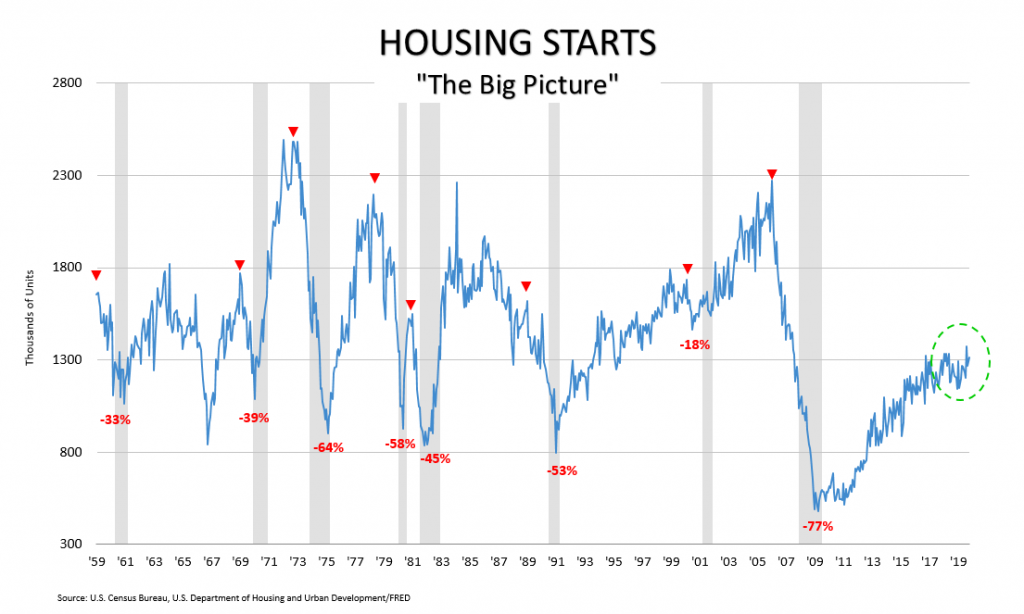

Residential housing, on the other hand, tells a different story. Housing’s combined contribution to US GDP averages 17%, and 3.9 local jobs are created for each single-family home being built according to the NAHB. As depicted in the chart, housing starts have been increasing of late. Month-over-month, total housing starts edged up 2%, and have increased 8.2% year-over-year. New construction in the South and West has been robust YoY at 15.6% and 6.8%, respectively, while the Northeast and Midwest markets have been much weaker. History shows that persistent downturns in housing starts frequently precede economic recessions. As of this post, housing starts are up!