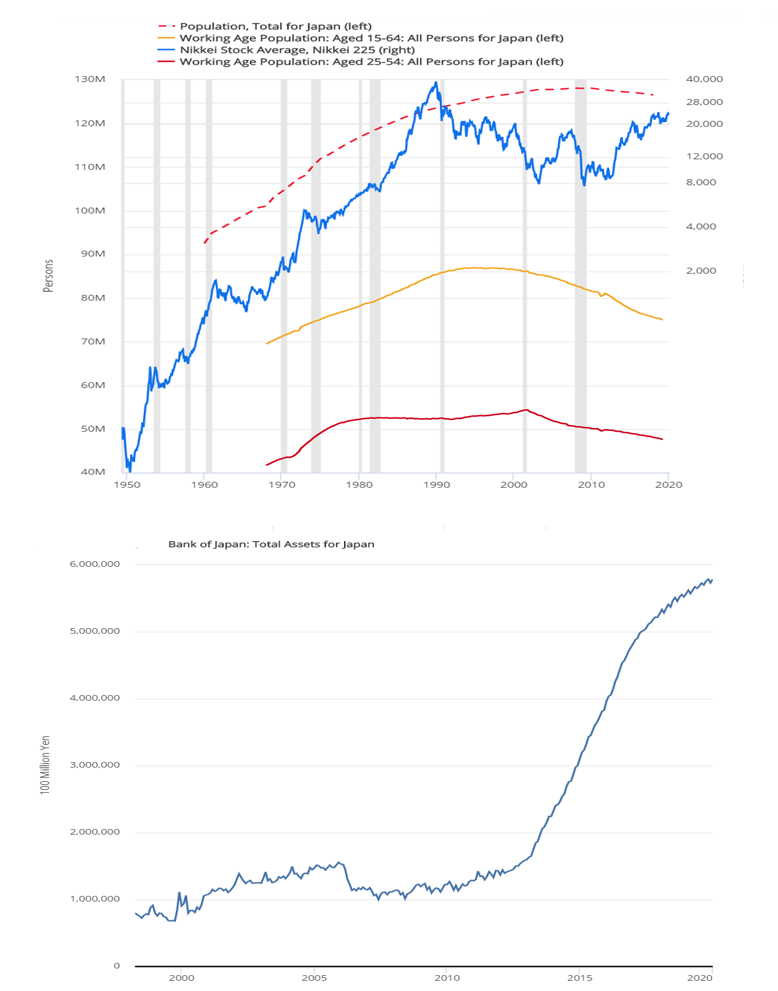

#Japanification was previously known as the process of becoming part of the Japanese society. The term embodied honor and adorned the Japanese way of existence. Now, the word “Japanification” is frequently smeared as a catch-all term portraying economies that are just sputtering along or running out of gas. After WWII ended, the Japanese rebuilt like never before. As noted in the chart, the Nikkei 225 Index (blue line) of leading Japanese equities rose from a low of 85 in 1950 to nearly 39,000 in 1989; those were halcyon days for all of Japan. It was a bubble and the bubble burst.

The other three lines depict total population, working-age population 15-64, and prime-age workers 25-54. For the most part, the workforce engine began stalling similarly to the Nikkei’s downturn. GDP for Japan peaked in ’97 and has increased a total of 2.6% since then. The Japanese yen has held its value comparatively well to other reserve currencies. So, how has the Nikkei Index rebounded in such fashion since the financial crisis? Would the >$5 trillion in Japan’s financial assets that the Bank of Japan has accumulated have anything to do with this? Perhaps now is a reasonable point to reassess cumulative risk, or better yet, rebalance and diversify. 1db.com/disclosures/ 1db.com