Readers of my posts know that I pride myself on being a consumer advocate. I believe unwaveringly that we are all connected in this human experience. I articulate that view in the economic realm vis-a-vis the 3Ps to Prosperity — People, Price, Performance. People always come first; price matters most, and performance counts constantly.

What gripes me to no end are the predatory pricing behaviors of leading automobile insurance companies. Why is it, since the Great Financial Crisis ended back in June 2009 that some industries refuse to pass on the savings to their customers? For example, leading technology companies continue to champion the consumer by offering better products and services inexpensively. Mobile phones have tons of apps that are often free that increase users’ productivity. Leading search and social media providers offer many of their services completely free. The cost of gasoline is 25% lower a decade later. New car prices are roughly 7% higher, and the list goes on.

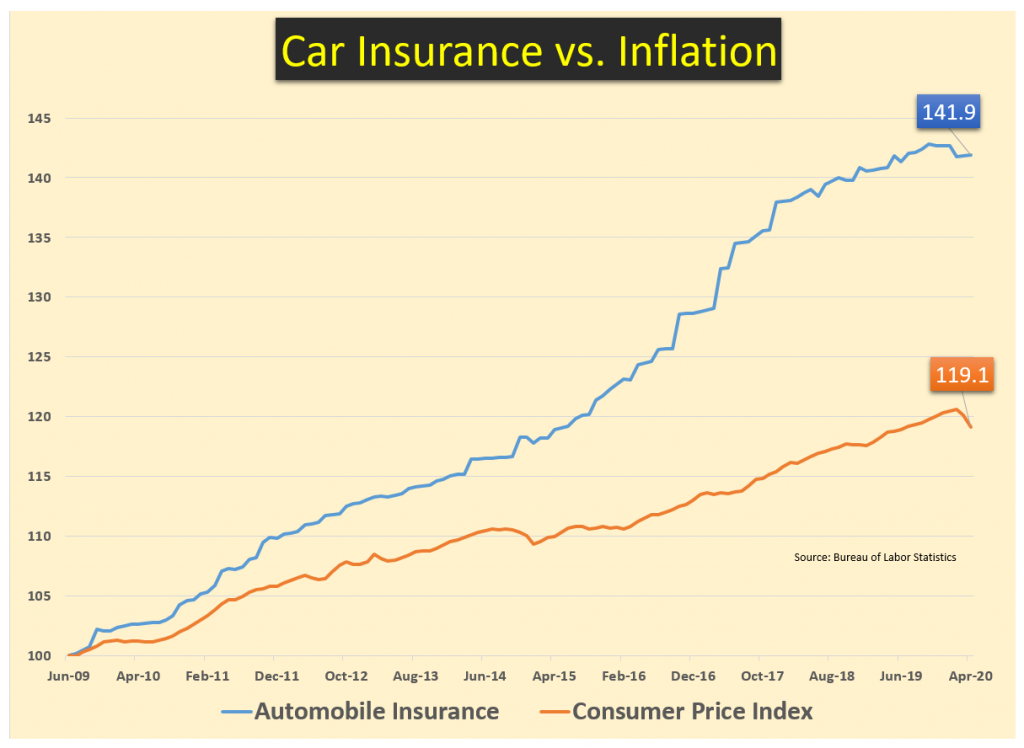

Not for automobile insurance carriers. Nope, they find every sneaky way and means to gouge their private customers. Inflation (consumer price index) has risen at a 1.6% compounded rate of growth, yet, car insurance premiums increased double that rate. Oh, and its not uniform, as a comparison, their commercial big business customers have seen modest rate increases, if that.

*There is a “Silver Lining,” rates have just been cut by 7.7% according to the CPI data. So, call your carrier and ask for a better rate, there is nothing to lose. We can celebrate afterward with extra money in our pockets.

P.S. If you are looking for a better way to invest and save, I recommend 1db.com.