Short version click here. Longer version, keep reading.

“This period, like the 1930s through 1945, is a time frame which I think you’d be pretty crazy to own bonds.” —Ray Dalio, CEO of Bridgewater

Rule #1 to Investing — Do Not Lose Money

Bridgewater Associates is the largest hedge fund in the world and is considered by some to be the most successful in history. Ray Dalio is the founder and brains that built this empire from scratch. Mr. Dalio appears to have thrown down the gauntlet on investing money into the bond market. His premise is straightforward, “The Fed’s unprecedented monetary response and fiscal stimulus by the federal government is reflationary in which the value of money will go down.” That’s his reality, and it is discouraging.

“The size and force of this shock will no doubt reveal weaknesses in the financial architecture, and we’ll have to go to work on those, but we’re still putting out the fire, we’re still trying to win, and I think we’ll be at that for a while.” —Jerome Powell, Federal Reserve

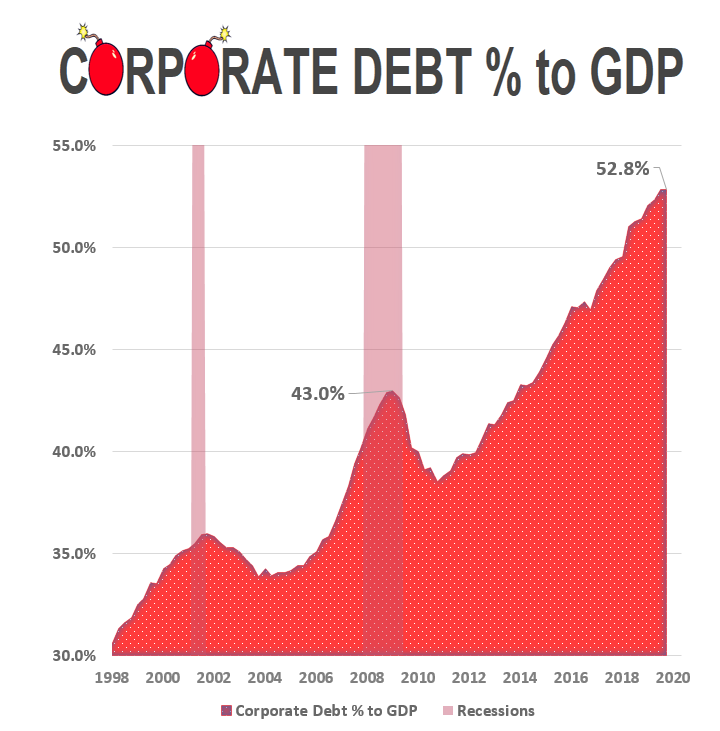

Let’s speculate under the current scenario that somewhere between $7 to $10 trillion in fiat dollars is currently being firehosed into the economy to prevent further widespread deterioration from the COVID-19 pandemic. Are there potential unintended consequences that could occur from the onset of this liquidity Carnaval? Let’s consider that this alleged spark of reflation occurs as planned and is manageable; but, what if it isn’t? Will this reflation spark simply simmer in glowing ambers, or will a larger flame ignite and wreak havoc?

In early March, as the stock market was in a fear freefall, corporate bonds followed suit by suffering double-digit price losses in a matter of days, which is unusual and unexpected. Treasuries and investment-grade corporate bonds (I.G.) have shown overtime to exhibit low or negative price correlation to equities-risk assets. For this reason, investors opt to have a certain amount of their capital invested into fixed-income holdings to offset and lessen the volatility in their portfolios. How was it then that I.G. securities sunk similarly to stocks and speculative-grade bonds (junk)?

The COVID-19 crisis sent I.G. and junk falling in tandem. I.G. bonds are loans made to public companies that credit agencies rate as having a relatively low risk of default. The proceeds raised by issuing bonds are purposed to operated and grow the business; it’s the American way. I.G. credits are integral for diversifying investors’ portfolios. Bonds have been a go-to asset class for preserving capital and generating income. Bonds are thought to lessen the swings of gut-wrenching volatility associated with market turbulence, but this time, it failed. Here’s the link.

“The Fed has redefined moral hazard by acceding its independence to the Treasury Department with the establishment of the Special Purpose Vehicle to purchase corporate bonds which is in direct violation of the Federal Reserve Act.” —Danielle DiMartino Booth, author of FED UP

I’ve been guiding savers and investors for 35 years. During this period, interest rates have been on a downward slope from 15.3% high in 1981 to .66% today. The spread between 10-year treasuries and inflation measured by the consumer price index has averaged around 2.5%. For investors willing to tie up their money for a decade, they expected to at least earn a couple percent interest above expected inflation. No more. Today, after deducting inflation at 1.5%, investors purchasing 10-year treasury notes are losing -.84% annually.

“Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” —Ferris Bueller

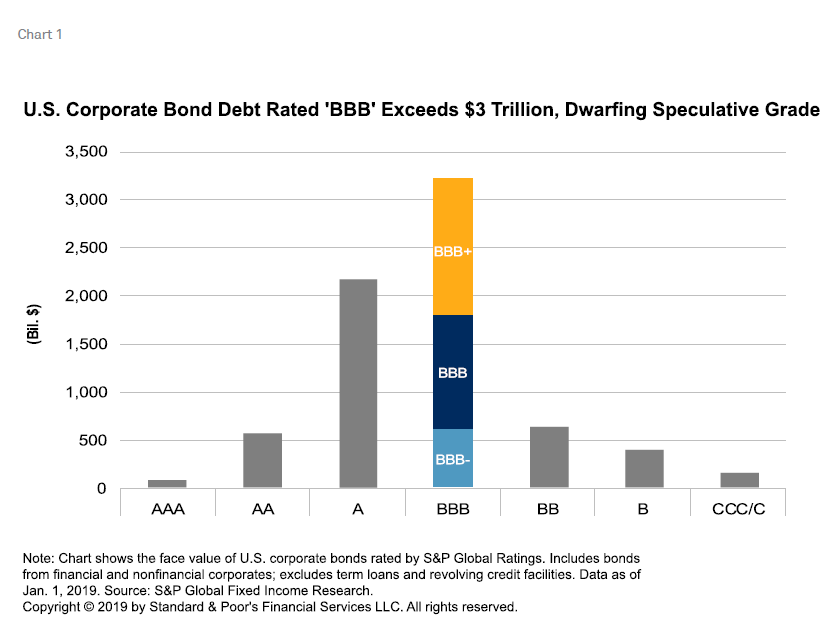

In a nutshell, a corporate bond’s risk is generally measured in two ways — credit risk and inflation risk. Credit risk is the ability of a corporation to generate cash-flow to meet its obligations to pay interest and principal as contractually obligated. Inflation or interest rate risk stems from the fact that when interest rates rise, the value of fixed-income assets with lower rates falls in price to the market rate. To limit credit risk, investors move up in quality. The safest bonds are US Treasuries, investment-grade bonds are a notch below government securities. Triple BBB bonds are considered investment-grade, along with A, AA, AAA; although, BBB is regarded as riskier.

Debt is the grease that lubricates the global economic machine. The financial services industry has been and continues to innovate at breakneck speed. And guess who is benefiting from the advancement? Consumers, that’s who! Today, because of #fintech savers and investors have access to diversified asset classes at institutional costs. Investing in bonds has never been easier or cheaper. So, what’s the hang-up? As credit expands unbridled, it makes good sense to keep a close watch on the credit ratings of the bonds in the portfolio.

“For investors, the task ahead is tedious but necessary: going through portfolios name by name to reduce downside exposure to corporate and sovereign defaults while also retaining the potential for returns should the Fed continue backstopping markets. The time will come to move into full recovery mode. But not yet.” —Mohamed. El-Erian, Ph.D

Ratings Then and Now

Which brings this post to a close. In summary, Nonfinancial corporate indebtedness has surpassed 50% of GDP. And I’m unsure of how accurate the rating agencies when it comes to assessing the creditworthiness of these outstanding trillion-dollar obligations. It happens fast, in less than a decade, the global I.G. corporate bond market has seen its share of BBB bonds, the lowest-rated of investment-grade issues swell to over 50% of all outstanding I.G. debt. For conservative, risk-averse investors, consider moving up in credit quality, such as AAA-rated bonds.

Important Disclosures

Any views, thoughts, and opinions pertaining to the subject matter presented in this post are solely the author’s subjective opinions and do not reflect the official policy or position of 1st Discount Brokerage, Inc. Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Any examples, outcomes, or assumptions expressed within this article are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Dollar-cost averaging, diversification, and rebalancing strategies do not assure a profit or protect against losses in declining markets. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses in declining markets. Assumptions made within the analysis are not reflective of 1st Discount Brokerage, Inc. nor its personnel. 1st Discount Brokerage, Inc. is a licensed FINRA broker-dealer and Registered Investment Advisor. Securities offered through 1stDiscount Brokerage, Inc., Member FINRA/SIPC.