As a professional money manager, I’ve observed over the course of 36 years the imperative of putting money to work and making sound investments. Investing one’s earnings for long-term capital appreciation and increasing income has been a tried-and-true pathway towards achieving and sustaining financial well-being.

So, how can a person or family that is doing its very best to get ahead invest more on the continuum? An efficient and intelligent way is to lower ongoing personal expenditures and reallocate the extra funds into reoccurring savings and investments, by way of fintech, i.e. wealth-tech.

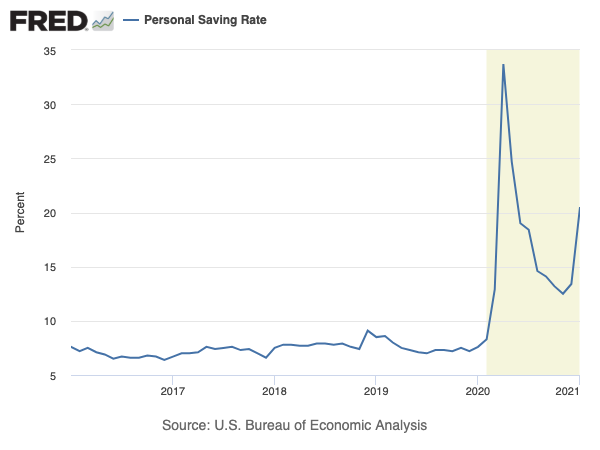

Here is today’s tip! The pandemic has anchored folks to their homes far more than pre-coronavirus. No doubt, the virus has upended the lives of many, yet still, nearly 90% of the workforce somehow remained employed during this crisis. During which, consumer spending habits decreased. By folks not being out and about as much as before, households at large increased their savings by driving their automobiles less, there, in turn, spending less on gasoline, tires, and service, purchasing fewer impulse items, by eating at home more often and curtailing travel and entertainment costs, as depicted below, the Personal Saving Rate has soared.

Which brings me to Today’s Tip → CUT CAR INSURANCE RATES

There are various ways and means to saving monthly on your car insurance premiums now!

- Call your carrier and ask them for a better rate, your job and education may provide a lower premium according to Consumer Reports

- Pay Per Mile could save you a reasonable sum for those with limited mileage

- Consider enrolling in a telematics program with your insurer

I believe the best days of life have yet to come. My purpose and opportunity are to provide access to professional money management to everyone. 1DB.com enables anyone to have their funds invested into financial securities by way of human insight and advance algorithms. 1DB offers automated investment solutions through our digital advisory services to enable those seeking fintech efficiencies with human sentience.

The future is coming right around the corner, what is often called our “golden years.” Think about it, the “golden years” require “gold.” There is an ancient proverb that says, “The best time to plant a tree was 20 years ago, the second-best time is now.”