“When times are worst, mankind is best.”

The headlines this morning bleed red. Many investors are anxious, rightfully so, about Eastern Europe’s unprovoked incursion. As I type these words air assaults and artillery squads are wreaking hell.

We are witnessing in real-time the ravages of war. Risk assets are under severe pressure. Investors at large appear to be in fright and flight mode. History rhymes rather than repeats itself, but no one can foretell the direction or outcome of a conflict with complete certainty.

My friend, Sam Stovall, Chief Investment Strategist reminds market participants that this too shall pass.

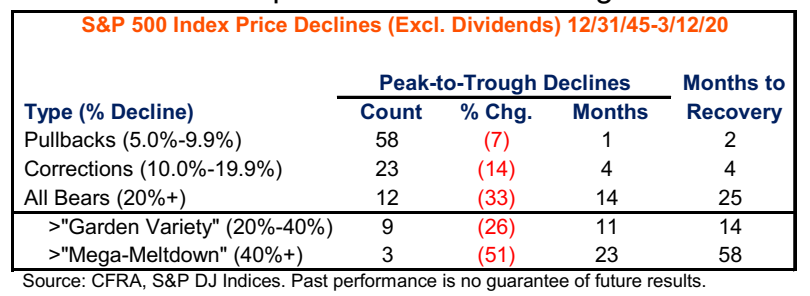

Since World War II, the S&P 500 has endured twelve bear markets and twenty-three corrections. Pullbacks are selloffs of 5%- to 9.9%, corrections are declines of 10% to 19.9%, and bear markets are drawdowns greater than>20%. As of 11:21 this morning, 2/24/22 the index is in correction territory.

Here’s a closer look at the internal price destruction within the S&P 500 from the ground-up.

S&P 500 Companies Stock Price to 52-Week Highs

- No stocks are trading above their 52-week highs

- The S&P 500 is has fallen >12% from the start of the year

- 45% have fallen in bear market range

- 85% are garden-variety bears minus 20%

- 15% are in mega-meltdown bears minus 40%

- 37% are in a correction

- 14% remain as pull-backs

- 10 of 11 sectors are negative

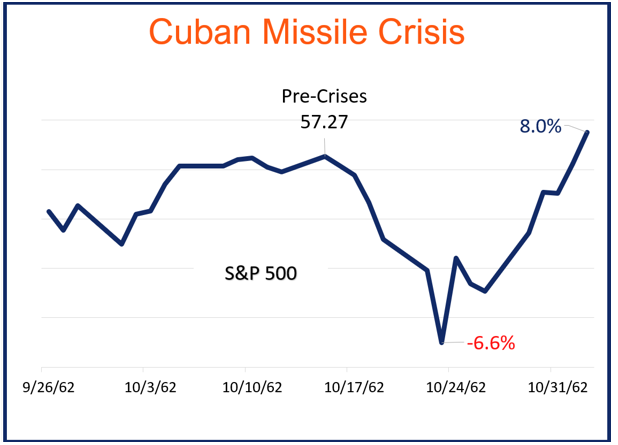

1962 Cuban Missile Crisis

Warren Buffet has said, “Buy on bombs. Sell on trumpets.” During the mid-weeks of October 1962 stocks fell by over 5% in a week, then bottomed. The market retraced the entirety of the pull-back by the end of the month, and rose an additional 10% by year’s end.

Who knows what will happen next in this war. How long will it last? What will be the outcome?