“The Fed has redefined moral hazard by acceding its independence to the Treasury Department with the establishment of the Special Purpose Vehicle to purchase corporate bonds which is in direct violation of the Federal Reserve Act.” —Danielle DiMartino Booth, author of FED UP

What happened in early March that sent bond prices tumbling in a matter of days? High-quality bonds are considered a go-to asset class for investors seeking balanced portfolios. Treasuries and I.G. corporate bonds exhibit low or negative price correlation to equities (risk assets). For this reason, many investors choose to have a certain amount of fixed-income holdings to offset and lessen the volatility in their portfolios.

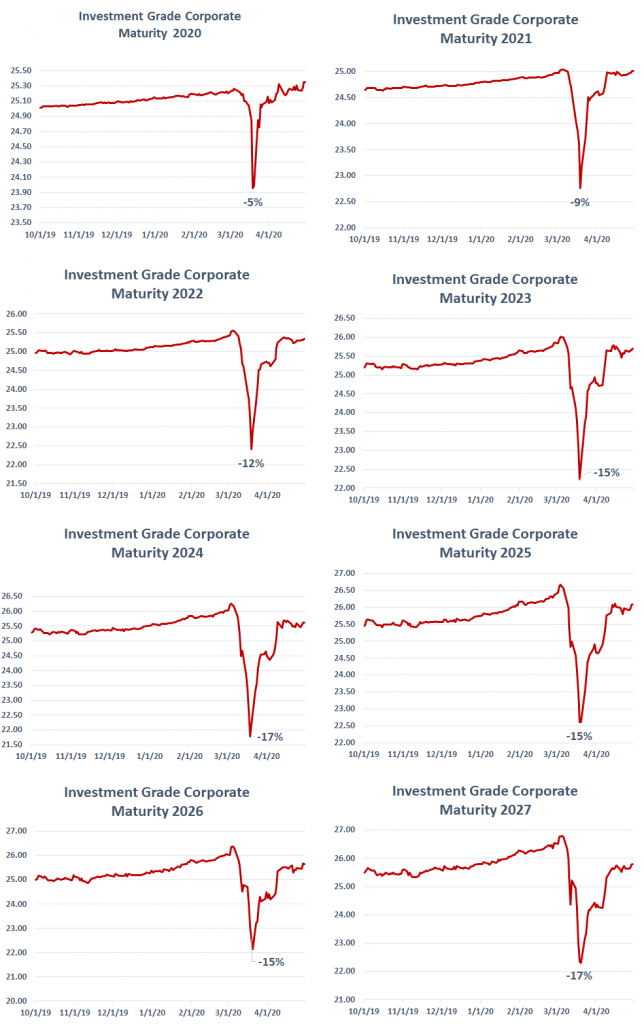

How was it that investment-grade (I.G.) securities sunk similarly to speculative-grade (Junk) bonds? The covid19-crisis sent I.G. and Junk bonds falling in tandem. I.G. credits are a means to diversify investors’ portfolios and lessen the volatility associated with market turbulence, but this time; it failed.

Then, the Fed moved aggressively into the capital markets as a buyer of last resort. A “Secondary Market Corporate Credit Facility” was launched so that the Reserve Bank may purchase in the open market corporate debt issued by eligible issuers. Which brings up the questions, how much, and how long? According to the press release, up to $250 billion, through September 30, 2020.

The charts below illustrate the price selloff of investment grade and junk bonds.