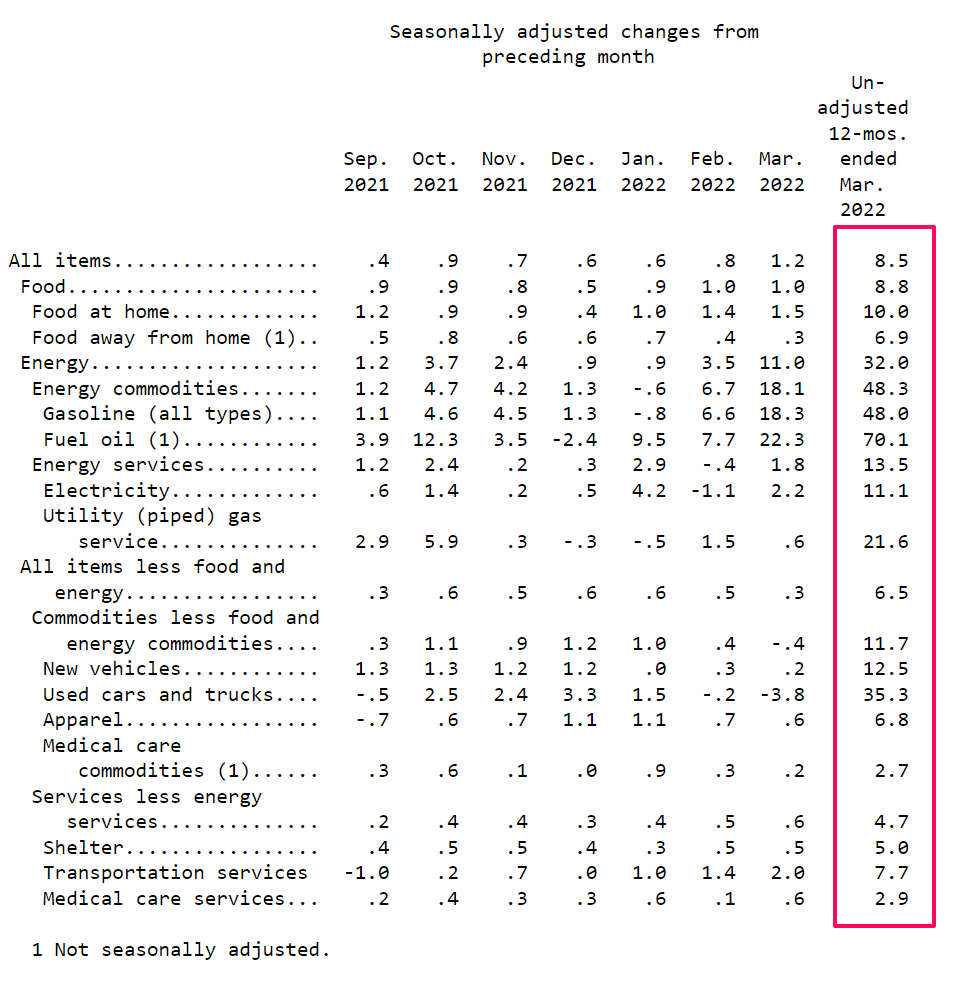

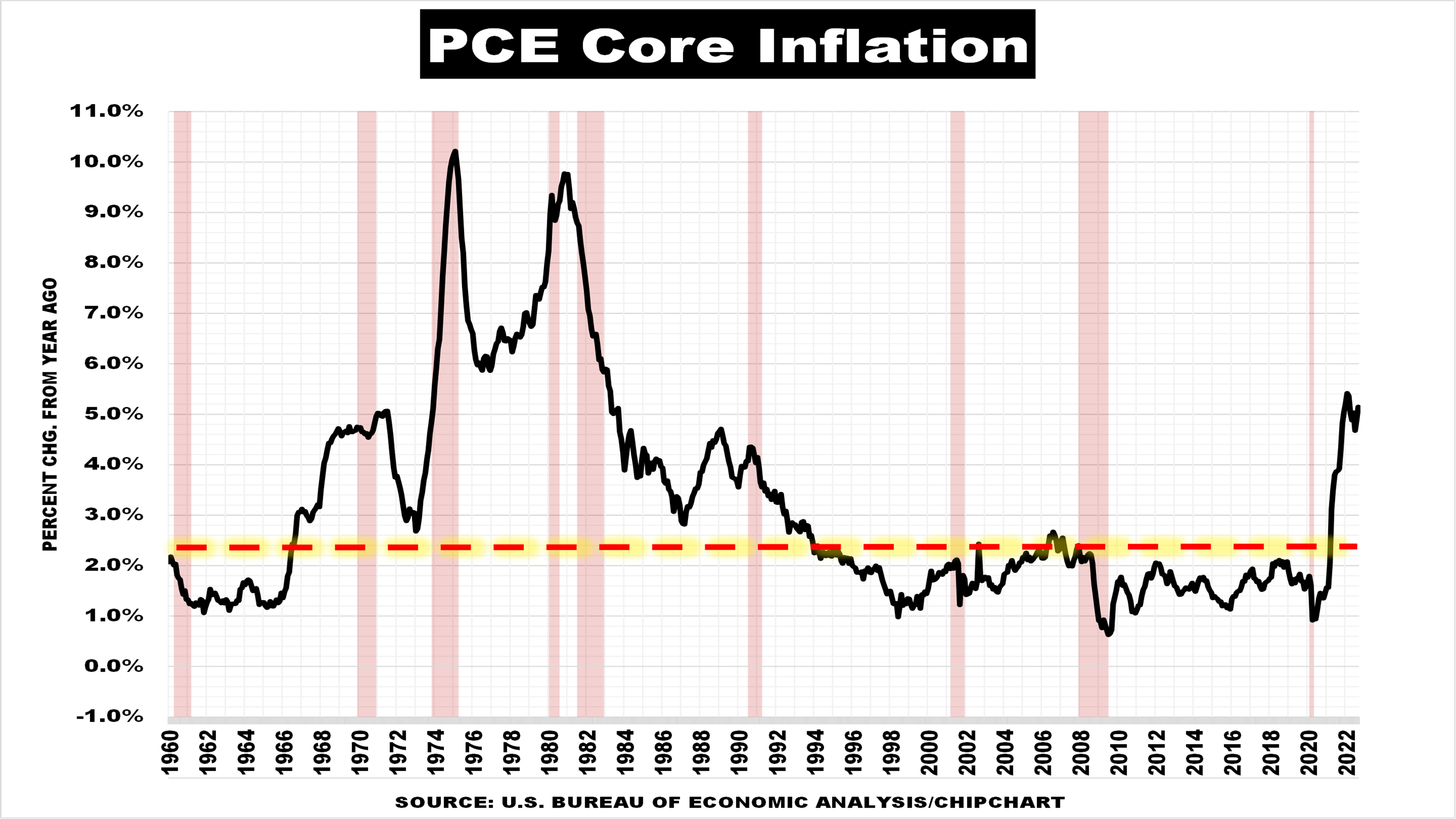

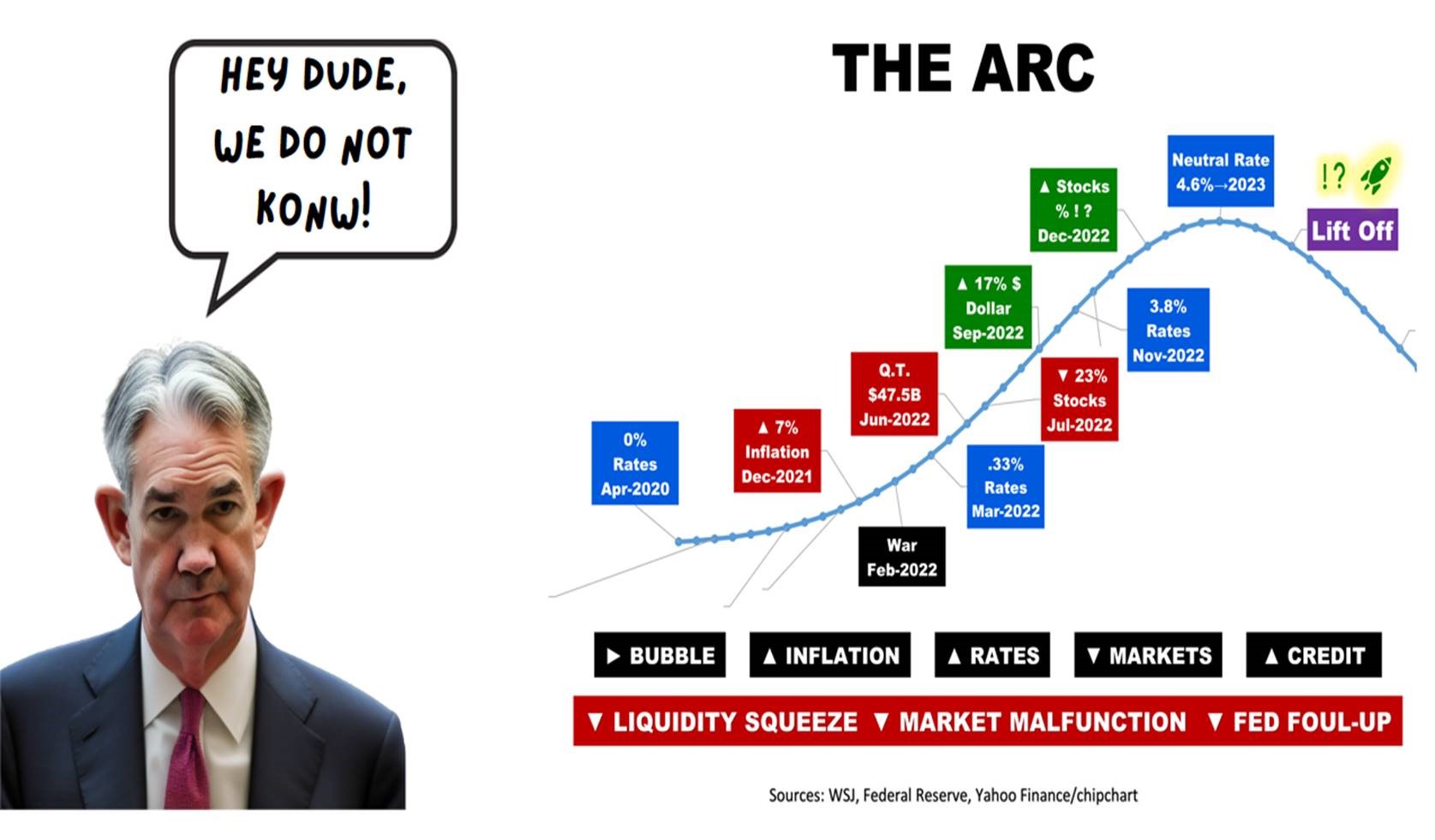

Why did the Fed wait until March 16, 2022, to raise the Fed funds rate from zero to 0.25 percent, with inflation running at 8.55%? Why did the Federal Reserve’s expansive monetary policy, known as ZIRP (zero interest rate policy), create bubbles in crypto, SPACS, meme stocks, and unprofitable technology companies and then burst it?

read more FED’S ZANY ZIRP FLUB-UP