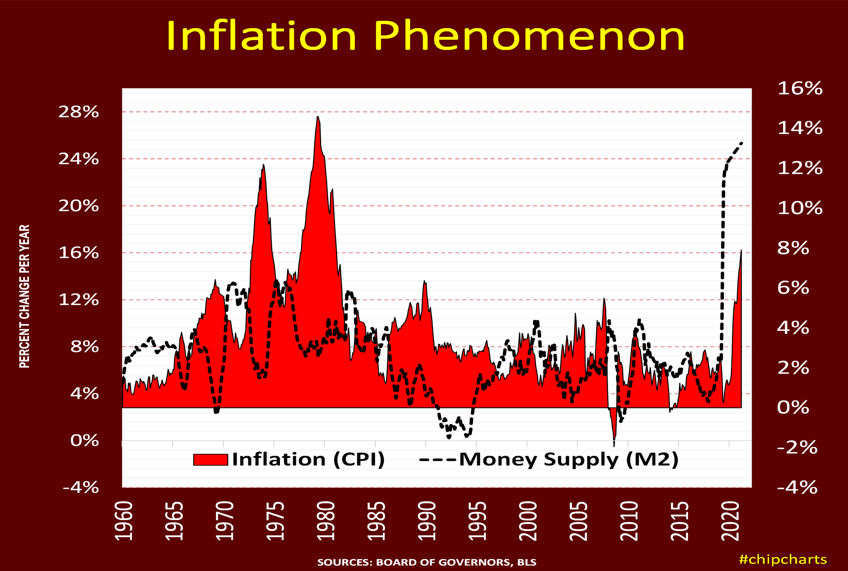

???????????????????????????????????????? ?????????????????????????????Once upon a time, way back in February 2021, our “non-partisan” Congress authorized the use of the FED’s experimental drug “printing tons of money.” The #FED began injecting its version of the Covid-19 vaccine posthaste. The purpose of the FED’s potent elixir was to rehabilitate the world’s leading #economy (not FDA approved). ???????????????????????????? ???????? ???????????? ????????????????????The Fed’s initial inoculation commenced

read more ♫????????????????????????????, ????????????????????????????, ????????????????????????????, ???????????????? ???????? ???????????? ???? ????????????????????♫